Stripe IPO Strategy: What to Know About a Possible Public Listing

About Stripe

Stripe: A Leading Player in Fintech

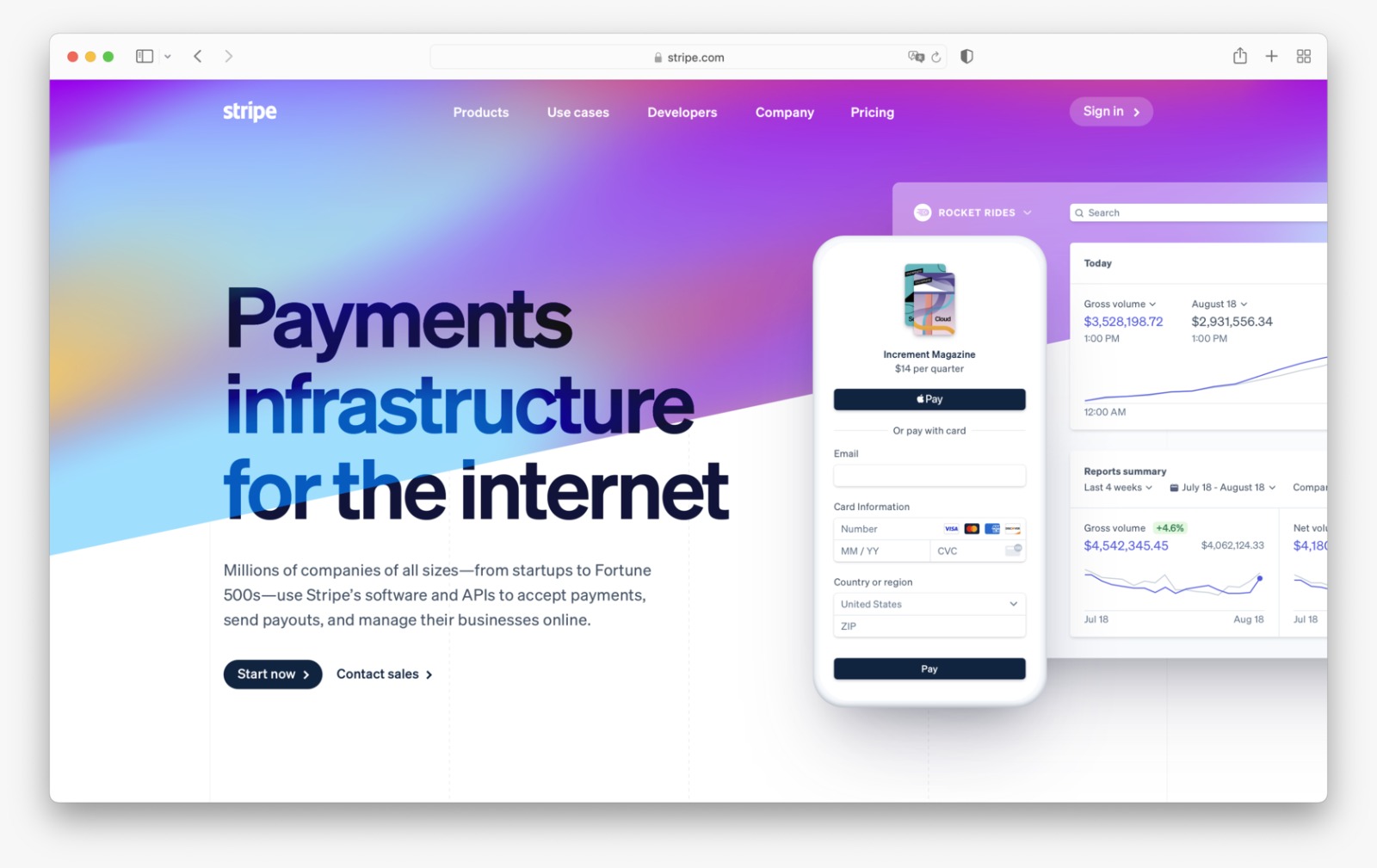

Stripe is one of the largest private fintech companies in the world, with reports suggesting it processes over $1 trillion in transactions annually. Its platform supports businesses of all sizes — from startups to large enterprises — including global brands such as Amazon, Shopify, and OpenAI.

Why a Potential IPO Matters

If Stripe decides to go public, it would likely be one of the most closely watched IPOs in the financial technology sector. Analysts highlight:

-

Global scale: Billions of transactions processed each year.

-

Wide adoption: Used by e-commerce platforms, enterprises, and developers.

-

Innovation: Expanding from payment processing into broader financial infrastructure.

Looking Ahead

While there has been speculation about timing, Stripe has not confirmed an IPO date. If and when it occurs, the listing would attract significant attention from both the technology and financial industries.

Sign up for updates and educational resources about Stripe and potential IPO news.

Post-IPO Growth Levers

-

Enterprise & Global Push: Expand in Asia/LatAm and deepen banking partnerships.

-

M&A for Gaps: Acquire fraud prevention or SaaS tools to bundle into payments stack.

-

Shareholder Perks: Mimic Tesla’s “AI Day” with “Payments Innovation Summits” to retain retail investor hype.

Regulatory Prep & Risk Mitigation

-

Preempt S-1 Scrutiny: Clearly address competition (Adyen, PayPal), crypto volatility (Stripe just brought back crypto payments), and antitrust risks.

-

Banking Charter Long Game: Keep pursuing industrial bank charter (like Square) to reduce partner dependencies.

The Endgame

- Stripe is one of the most closely watched private fintech companies, with reported valuations making it one of the largest in the sector. If the company decides to move forward with an IPO, it could represent an important milestone in its growth and role within the global payments ecosystem.

Sign up for updates and educational resources about Stripe and potential IPO news.

More About Stripe

Stripe combines Silicon Valley innovation with robust financial engineering to move money seamlessly across borders and currencies. As it approaches its long-awaited IPO, the company stands not just as a payments processor, but as the foundational layer enabling the next generation of internet businesses to launch, scale, and thrive in an increasingly digital-first global economy

-

Factors Analysts Watch Around a Potential Stripe IPO

While Stripe has not announced an IPO, market observers often discuss the types of factors that could influence the timing and structure of any future listing. Below are some commonly referenced themes:

1. Market Conditions

Analysts suggest that IPOs are often timed to align with favorable market conditions, such as stable interest rates and positive investor sentiment toward technology companies.

2. Listing Options

If Stripe were to go public, it might consider major exchanges like Nasdaq in the U.S. Some observers have also speculated about the possibility of additional listings in other markets to broaden investor reach.

3. Positioning in Fintech

Commentary often highlights Stripe’s scale in global payments and its role in areas such as embedded finance, business banking tools, and fraud detection technologies.

4. Investor Interest

Reports have noted that institutional investors, private equity firms, and sovereign wealth funds have shown interest in fintech IPOs. Whether these groups would participate in a Stripe IPO would depend on the offering’s final structure and terms.

5. Valuation Considerations

Stripe’s past private valuations have reached as high as $95B. Some analysts speculate that a future IPO valuation could reflect both the company’s revenue growth and broader market conditions, though nothing is confirmed.